Credit Consultancy Service

Our credit consulting services offer personalized strategies to navigate the complex world of credit. From understanding your credit report to implementing practices for improvement, our experts guide you every step of the way. Enhance your creditworthiness and unlock new financial possibilities with our tailored advice and support.

Enroll Now

$497 start-up fee

$97 a month

Cancel at any time following the initial period

Here's how our Credit Consultancy Service will help you:

Personalized Credit Strategy

Your financial journey is unique. That's why our services are customized to fit your individual needs, providing you with a clear and personalized roadmap to navigate the complexities of your credit report.

Expert Guidance & Support

Our seasoned credit consultants are your partners in financial success. Armed with their deep knowledge and insights, you'll learn effective credit management practices to enhance your creditworthiness.

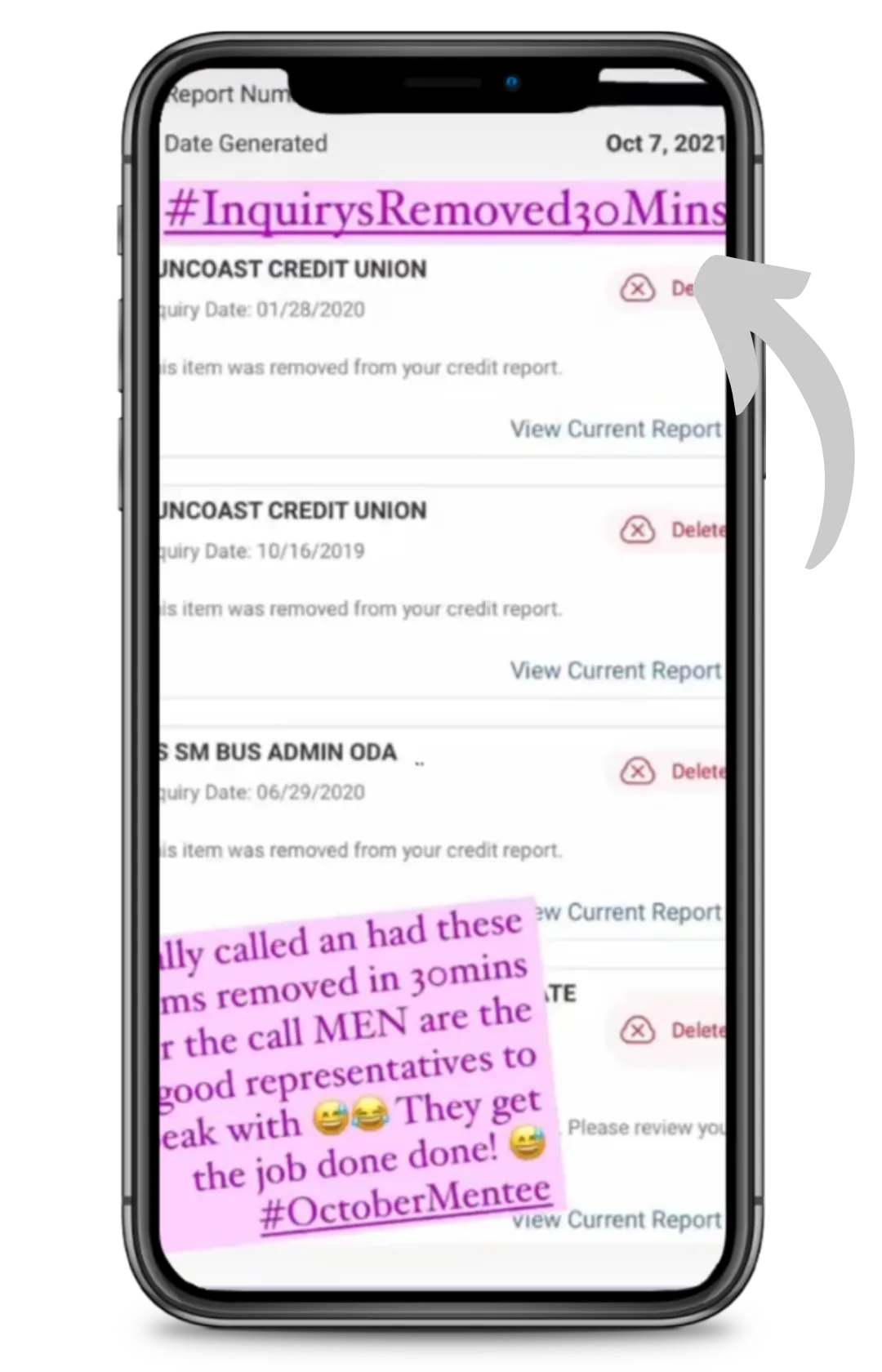

Error Identification & Correction

Say goodbye to inaccuracies on your credit report. We meticulously identify and correct errors, challenging unjust marks to ensure your credit score truly reflects your financial integrity.

Affordable Investment for Future Fundability

Getting started with our straightforward pricing. For an initial investment of just $497, followed by a manageable monthly fee of $97.

You can cancel at any time.

The Process

Here is the onboarding and service process you can expect when working with us

1. Complete Enrollment

After completing the payment for enrollment you will be prompted to review our service agreement for your signing. In our service agreement we outline what we will need from you in order to get started working with you. This will also include the steps necessary to upload required documents. This shouldn't take more than 5 minutes to complete.

2. Partnered with a Dedicated Credit Consultant

Once we see you have submitted all the required documents and information, we will par you with one of our dedicated credit consultant team members. They will start with assuring that we have everything we need to get started. If we need more information, you will be contacted via email or text message to assure we don't loose any valuable time.

3. Comprehensive Credit Analysis

Our experts will conduct a thorough review of your credit report from all three major credit bureaus. We’ll identify any inaccuracies, areas for improvement, and strategize the best course of action.

4. Customized Plan Development

Based on the analysis, we’ll develop a personalized credit repair and improvement plan tailored to your needs. This plan will outline the steps we’ll take together to enhance your creditworthiness.

5. Implementation

With your approval, we’ll start implementing the plan. This includes disputing inaccuracies, negotiating with creditors if necessary, and advising you on practices to improve your credit score.

6. Regular Updated and Adjustments

You’ll receive regular updates on the progress of your credit repair journey. Based on the evolving situation, we may adjust our strategies to ensure the best outcomes for your financial health.

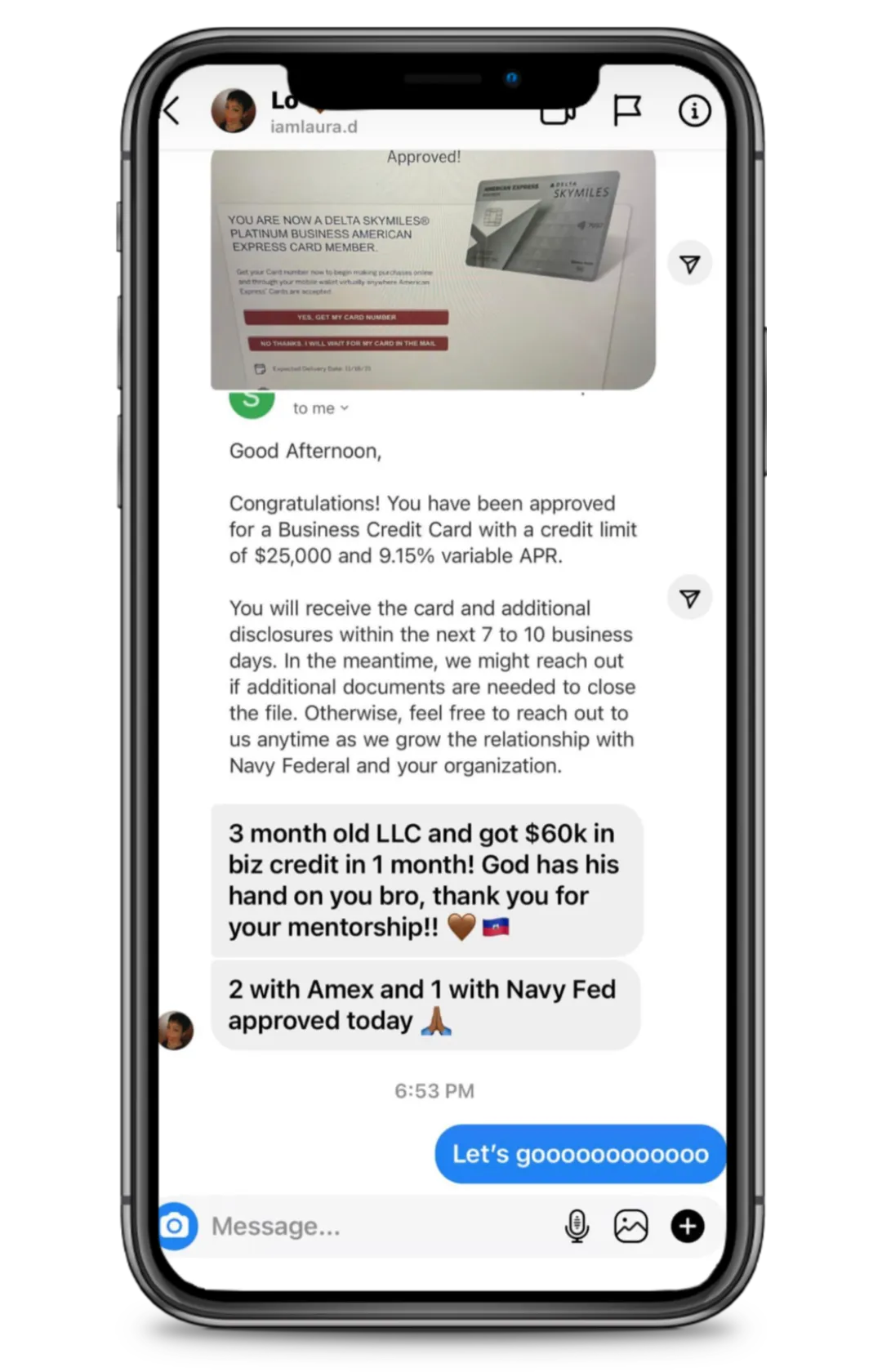

7. Achieving Your Fundability Goals

As your credit improves, we’ll guide you on how to leverage your improved credit score to achieve your financial goals, whether that’s securing a loan, buying a home, or planning for the future.

Grab This Opportunity Now